Indices

Eurekahedge Equal Weighted Hedge Fund Index

EQUAL WEIGHTED HEDGE FUND INDICES

ASSET WEIGHTED HEDGE FUND INDICES

SPECIALIST ALTERNATIVE FUND INDICES

INVESTIBLE BENCHMARK INDICES

METHODOLOGIES

INDEX PRESS RELEASES

- Index Flash Update (June 2022)

- Index Flash Update (May 2022)

- Index Flash Update (April 2022)

- Eurekahedge launches new benchmark Eurekahedge Multi-Factor Risk Premia Index

- Eurekahedge launch four benchmark indices tracking volatility-based investment strategies

- Eurekahedge and MPI announce new benchmark index tracking the top 50 hedge funds

- Eurekahedge and ILS Advisers launch new USD hedge index

- Eurekahedge launches new insurance linked securities index

- Eurekahedge Asset Weighted Index goes live

- Eurekahedge Asset Weighted Index press release

- EU Benchmark Regulation

With the rapid growth of hedge funds in the last decade across the globe, there has been a strong demand for benchmarking tools by single- and multi-manager clients seeking to benchmark against a relevant index that more closely mirrors their regional and strategic mandates, and by investors looking to ensure that their managers are outperforming a ‘bucket’ of their peers. To monitor this significant expansion in the alternative fund industry, Eurekahedge launched a fully comprehensive suite of 200+ hedge fund indices with subsets based on region, country, strategy and fund size, available at http://www.eurekahedge.com/Indices and on Bloomberg at HDGE.The Eurekahedge Equal Weighted Hedge Fund Index methodology is as follows.

| Methodology - Hedge Fund Index | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Mean returns The monthly index values are the respective mathematical means (average) of the monthly returns of all hedge fund constituents in the index at that time. Unlike other indices, they are not asset-weighted (see relevant paragraph below) nor median returns. A simple example of the differences between a mean and a median return index is as follows:

Essentially, the median return index ignores all values above and below the middle-ranked value (in this case, 4%) and in the case of a population of returns that demonstrate kurtosis will generally overestimate or underestimate the average of the population. In the example above, the true mean is 2%; however, the median return is 4% due to this value (4%) being the middle-ranked value. Return definition The returns reported in the database as well as being included and calculated for indices are monthly returns provided by hedge funds on a monthly basis. The returns are measured in terms of the gain/loss of the total portfolio values by performance (net of all fees) and net AUM inflow/outflow are excluded from it. Equal weighting The indices are not asset-weighted. We simply give an overview of the average performance of hedge funds, without attempting to highlight monthly inflows and unjustly overweigh the performance of certain funds due to good marketing staff or location in investor hot spots. Taking the above data, we can see in the table below that for a single month's returns, the difference in index values is 2.16%, depending on whether an index is weighted by the fund's asset size or not. Essentially, a weighted index like this is ignoring the performance of 70% of the funds in it due to their comparatively lower asset size.

Currency Equal weighting also encompasses funds denominated in different currencies, such as US dollar, euro and Japanese yen. The index is purely an average of the performance of the constituent funds in their local currencies. Unique funds Only ‘unique’ funds are selected for the index (no duplicate share classes, currency denominations, onshore and offshore versions of the same fund, series, etc.). For example, if we include both sets of performance numbers for the European Absolute Return Fund-USD and the European Absolute Return Fund-EUR in our database, we would only include one set of performance numbers in the index. For arguments’ sake, we take the fund with the most assets in that class. Dead, closed and new funds If we discover new funds with historical performance, these funds will be immediately included in the index and all returns rebalanced accordingly. If a fund dies, its track record will remain permanently in the index. Furthermore, since the rationale behind our suite of indices is relative benchmarking (rather than making them investible), funds that are closed for further capital inflows are also included in an index. Rebalancing on monthly basis The Eurekahedge Equal Weighted Indices provide a broad performance measure over all the hedge funds in our database and no rebalancing is required to take place. Who decides how funds are categorised Funds are categorised primarily based on their investment regions and style. We do not include duplicate funds in the indices. For example, the Eurekahedge Asian index comprises funds that allocate 90% of their strategy to Asia Pacific – the region consisting of India, Singapore, Malaysia, Indonesia, Thailand, Australia, New Zealand, China, Hong Kong, Taiwan, Korea and Japan. Requirements on AUM We do not have minimum AUM requirements for the funds to be selected into the broad index. In a case where the fund has stopped reporting to us with the latest performance return, we will exclude the fund from the indices.

Track record |

| Regionals |

|---|

|

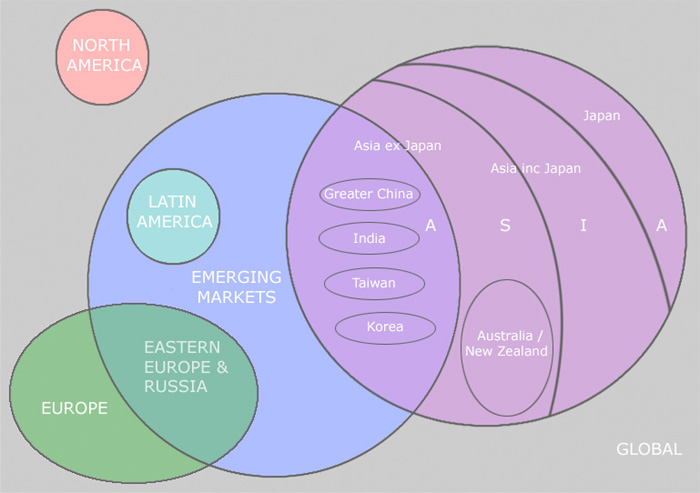

90% of the regional mandate of the fund must be in a specific region or country. For example, there are 26621 European funds in our database, but we have only 2852 funds in the Eurekahedge European Hedge Fund Index. Many Europe-based funds do not exclusively allocate to Europe but have significant allocations to the US. Likewise, US-based funds that allocate exclusively to Europe will be included in this index. Essentially, the head office location is irrelevant. To further elaborate on the regional indices: The Asian index comprises funds that allocate 90% of their strategy to Asia Pacific – the region consisting of India, Singapore, Malaysia, Indonesia, Thailand, Australia, New Zealand, China, Hong Kong, Taiwan, Korea and Japan. The broad Asian index encompasses the following component indices: The Asia inc Japan index comprises funds that allocate to Asia Pacific but excludes hedge funds with pure Japan mandates. This index includes funds with partial allocations to Japan, such as an ‘Asia inc-Japan’ mandate. The Asia ex-Japan index comprises funds that allocate to Asia Pacific but have 0% exposure to Japan, i.e. it excludes all funds with full or partial allocations to Japan and includes funds investing in any country or region in Asia outside of Japan. The Greater China index comprises funds that invest in mainland China, Hong Kong, Macau and Taiwan. The Australia/New Zealand index comprises funds that invest in Australia and New Zealand. Other country-specific indices comprise funds that pursue a pure single-country strategy, such as Japan, Korea, India and Taiwan indices. The European index comprises funds that allocate to Europe, including Iceland, Greenland, Turkey, Russia and the CIS, and South Africa. The North American index comprises funds that allocate to the United States, Canada and Alaska. The Latin American index comprises funds that allocate to Mexico and Central and South America. The Emerging Markets index comprises funds that allocate 90% of their strategy to emerging markets - either funds that allocate to a single emerging market country, emerging market region or globally. Emerging market regions are defined by Eurekahedge as developing Europe (Central and Eastern), Latin America, Russia, Asia (excluding Japan, Australia and New Zealand), the Middle East, Africa and the Caribbean. A visual representation of these overlapping regional mandates is as follows:

|

| Strategies |

|---|

|

The Eurekahedge Hedge Fund Indices include the following strategies: Arbitrage Involves the purchase of an asset followed by immediate resale, exploiting pricing inefficiencies in a variety of situations in similar or different markets. It is usually regarded to have low risk, but this may differ depending on the circumstances. The most basic form of arbitrage is triangle arbitrage, where an asset is being sold at two different prices at different markets. Such gaps are often closed off almost instantly. Merger arbitrage takes place following M&A announcements as funds may purchase stocks of the target company and short the stocks of the acquiring company. Capital structure arbitrage involves taking advantage of pricing anomalies among different securities issued by the same or related firm. For example, a fund might go long on a high yield bond and short the stock of the company. Given the nature of opportunities pursued, returns tend to be market neutral. CTA/Managed Futures Invests in commodity futures, options and forex contracts either directly or through a Commodity Trading Advisor who is registered with the Commodities Futures Trading Commission. Distressed Debt Invests in the debt of companies that are sick, bankrupt or in the course of a turnaround at deep discounts. Given the nature of these securities, there is selling pressure in the market as many of the institutional investors cannot own below investment grade securities. This results in lower demand, coupled with the negative publicity of a bankruptcy filing, leading to an undervaluation which this strategy is trying to capitalise on. Event Driven Exploits opportunities in specific situations, such as mergers, public offerings, leveraged buyouts or hostile takeovers, and is generally unaffected by the movements in the market or trends. They need not necessarily be limited to any particular investment style or asset class. One example of an event driven arbitrage strategy is merger arbitrage, distressed debt, or more generally speaking, distressed securities. Fixed Income

Invests in fixed income securities (long, short or both) and/or fixed income arbitrage (exploiting pricing anomalies in similar fixed income securities) opportunities, usually along with the use of leverage. For this strategy, they may focus on interest rate swaps, forward yield curves or mortgage-backed securities. Long/Short Equity Attempts to hedge out market risk by investing on the long (buy then sell as prices rise) as well as short (borrow, sell and buy as prices go down, and settle the loan) side of the equity markets. The fund’s net exposure to the markets is reduced if not completely hedged out, owing to the short-selling. Managers shift from stocks of small values to that of large ones, resulting in a tilt in the net long or short position to gain returns. Absolute returns are accentuated by such use of leverage and may also make use of options and futures. Note that this strategy is different from a true equity market neutral strategy. The key difference lies in the fact that the manager is betting that one stock will do better than the other relatively, regardless of the general market movement. Macro Funds A top-down strategy that tracks and profits from global macro-economic directional shifts or changes in government policies. This, in turn, affects foreign currencies/economies, interest rates and commodities. Managers using this strategy are usually involved in all kinds of markets, such as equities, bonds, etc. The use of leverage (and derivatives, in particular) accentuates the impact of market movements on fund performance. Multi-Strategy Adds a further layer of diversification to asset allocations (as opposed to merely diversifying across asset classes) by investing in more than one of the strategies described here. To loosely analogise, a multi-strategy fund would be the single-manager fund equivalent of a fund of hedge funds. The volatility for this strategy is considered to be variable. Relative Value This is an overarching classification and encompasses all strategies that use pair-trading, leverage in a variety of securities and aim to hedge out market risk. For instance, fixed income arbitrage, capital structure arbitrage and long/short equities are all technically relative value strategies. |

For more information on Eurekahedge indices, please contact us on +1 212 706 7020 (US office) or +65 6212 0925 (Singapore office), or email us at indices@eurekahedge.com.

Footnotes